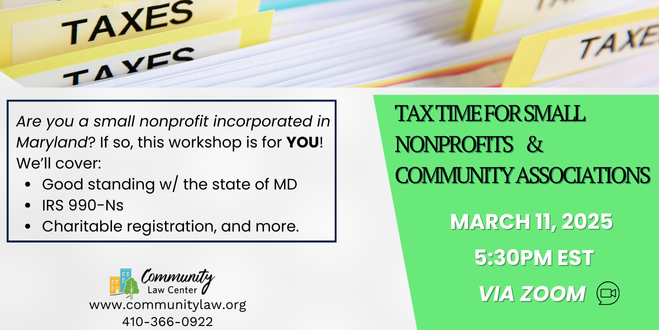

Learn about tax filing for nonprofits in this virtual workshop.

In this workshop, we will cover:

- Being in good standing with the state of Maryland

- Tax forms like IRS 990-Ns,

- Registering as a charitable organization,

- and more

Tax Time for Nonprofits workshop

Are you a small nonprofit incorporated in Maryland? If so, this workshop is for you! Find out how to determine whether your annual filings are in order. We will discuss good standing with the state of Maryland, IRS 990-Ns, charitable registration, and more.

Register for our online workshop ready to ask questions!

If you have additional questions regarding your organization after the workshop, attorneys from Community Law Center will be available for free brief legal advice consultations by phone or email. Groups may also be eligible to apply for free legal services.

L

Cost to attend the workshop

The cost for one person to attend the workshop is $30.

Accessing the workshop

This workshop will be presented virtually via Zoom. Registrants will receive a link to join.

Cancellations and Refunds

Refunds will be accepted up to 48 hours before the workshop. If you, or your designee, do not attend the workshop you signed up for, the fee is non-refundable.

Required Declaration Forms

Registrants will need to complete a brief form declaring the average household income for the organization (not for any individual). This paperwork is required by our funders for Community Law Center to keep in our records for informational purposes only.

Refunds will be accepted up to 48 hours before the workshop. If you, or your designee, do not attend the workshop you signed up for, the fee is non-refundable.

About the Presenter

Shana Roth-Gormley, Esq., is Senior Staff Attorney at Community Law Center. Ms. Roth-Gormley has been with the Community Law Center since 2014. Ms. Roth-Gormley has overseen the Pro Bono Program and taught many of Community Law Center’s workshops on nonprofit formation and governance, and vacant and nuisance properties. She also represents nonprofit clients, advocates for systemic change on issues of tax sale and vacant and abandoned properties and serves on the Maryland State Bar Association’s Delivery of Legal Services Section Council. She is a graduate of the UCLA School of Law and a member of the Maryland Bar.

p