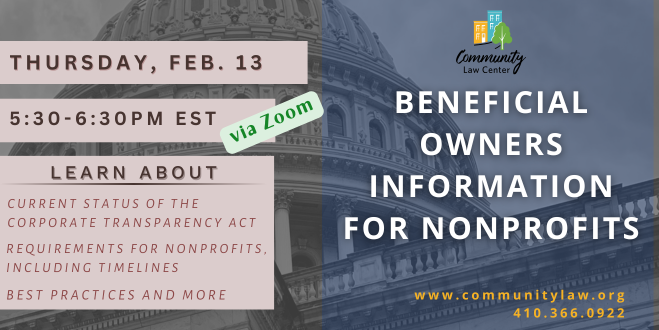

the current BOIR reporting limbo under the Corporate Transparency Act

Our ONLINE workshop will cover the current status of the Corporate Transparency Act, what it requires for various nonprofits specifically, and what timelines may be as it is currently being reviewed in federal court.

Who should register?

• All are welcome, though the focus will be on board members and others involved in any nonprofit organization who may qualify as a Reporting Company.

Beneficial Owners Information for Nonprofits and the current BOIR reporting limbo under the Corporate Transparency Act

The Corporate Transparency Act (CTA) was enacted to try to prevent money laundering, financial crimes, and terrorism-financing through the use, essentially, of shell companies that are not required to report ownership information. A Reporting Rule, issued in September 2022, required individuals who own or control certain companies (“Reporting Companies” who do business in the United States) to be divulged through the filing of Beneficial Ownership Information Reports (BOIR), starting in the year 2024. Multiple legal challenges have complicated expectations and deadlines for all Reporting Companies, including some nonprofits that may not cleanly fit into one of the exceptions and might otherwise be required to file BOIRs.

Reporting Companies are not currently required to file beneficial ownership information with FinCEN due to a federal court injunction while federal review (on appeal) of the constitutionality of the CTA is ongoing, but the Government’s position is to continue defending this law and to move forward with its BOIR requirements if/when allowed to do so.

- Who was (or will be) required to file: Learn about the specific nonprofit exceptions to Reporting Companies. Is your nonprofit a Reporting Company? What if we had recognition under 501(c)(3) tax exemption but our status was just revoked?

- Reporting: Who qualifies as “Beneficial Owners” since nonprofits have no owner, and what would the required information include?

- What about updates to our reported information?

- Timeline: How did the CTA get into this limbo state and what might we expect next?

- Best practices: How do I best prepare my nonprofit to be compliant and avoid problems?

Cost to attend the workshop

The cost for one person to attend the workshop is $30. Additional attendees from the same organization may sign up for a discounted rate! (The total cost for 2 participants from the same organization is $50. The total cost for 3 participants is $60.)

Accessing the workshop

The workshop will be presented in person via Zoom. A link will be sent out the day of the workshop.

About the Presenters

Denice Ko, Esq., is Deputy Director at Community Law Center. Ms. Ko joined Community Law Center in late 2017 as a volunteer attorney and became a Staff Attorney in 2019. She represents community associations and other nonprofit organizations for capacity building and nonprofit best practices, and provides legal services for a range of contract and compliance matters. Ms. Ko graduated from the University of Maryland School of Law and is a member of the Maryland Bar.